Gold: a 7,000-year history of success

The history of mankind is inextricably linked with gold. For millennia, the yellow metal has played an important role in civilization processes. Our society would not have been able to reach its current heights without such an effective financial tool at its disposal.

The influence of gold on the world order can be traced from ancient times to this day.

The source of power

People first learned about gold nearly seven thousand years ago. The peculiarity of this metal was obvious to our distant ancestors, they attributed mystical properties to it, considering it a particle of the sun.

In the photo: in Ancient Egypt, gold was an attribute of the pharaohs, a symbol of power, an element of sacred rites.

In the 7th century BC, Lydia, the kingdom that existed on the territory of modern-day Turkey, was the birthplace of first gold coins, thus gold became money, marking a new era in trade and economic development.

Gradually, other nations started to master the coin-minting technology. At different times, ambitious and influential countries strengthened their power with the help of gold, namely Ancient Rome, the Republic of Venice, Spain and Great Britain.

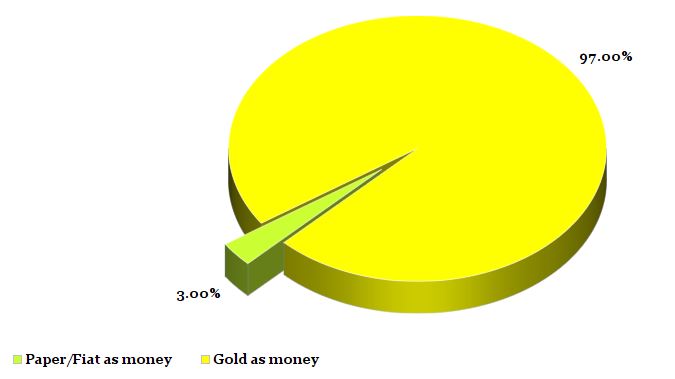

In the photo: over the last 2,500 years, gold has served humanity as money 97% of the time, while paper currencies – only 3%.

The building material of the new world

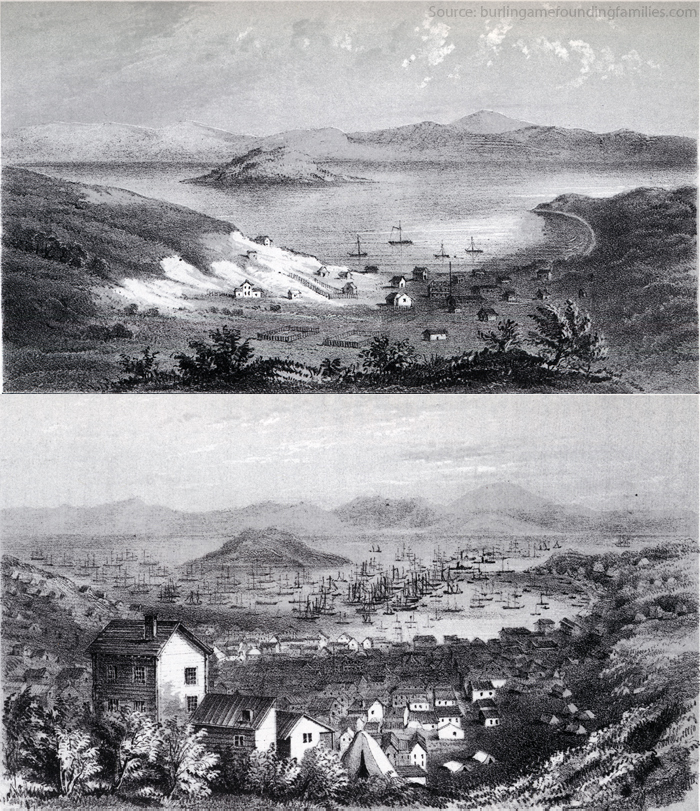

Gold was the reason why brave men made geographical discoveries and entered new lands. Flows of immigrants flocked to the places where the yellow metal was found. Once uninhabited regions started to flourish, experiencing a rapid economic growth. Thanks to the gold rush* of the 19th century, large cities emerged, such as San Francisco, Sydney, Johannesburg. The availability of vast gold deposits turned California into the most prosperous and populated state of the USA.

In the photo: the artist painted San Francisco of 1848 before the start of the gold rush (see above) and a year later, when the valuable metal (see below) was discovered there.

The increase in production allowed gold to occupy top positions in the financial arena. The main competitor – silver – was finally defeated and put into the back burner.

The pillar of economy

To ease trade operations between countries, it was required to introduce a single unit of value of national currencies. In the 19th century, gold was chosen as the monetary standard. The following qualities of the precious metal contributed to this:

- Durability.

- Portability combined with high value.

- Worldwide recognition.

In this regard, the pioneer was the United Kingdom, which declared the pound sterling freely exchangeable for gold in 1821. Subsequently, all the leading powers joined this system. The period of the gold standard* was marked by low inflation, the stability of exchange rates and the international trade boom.

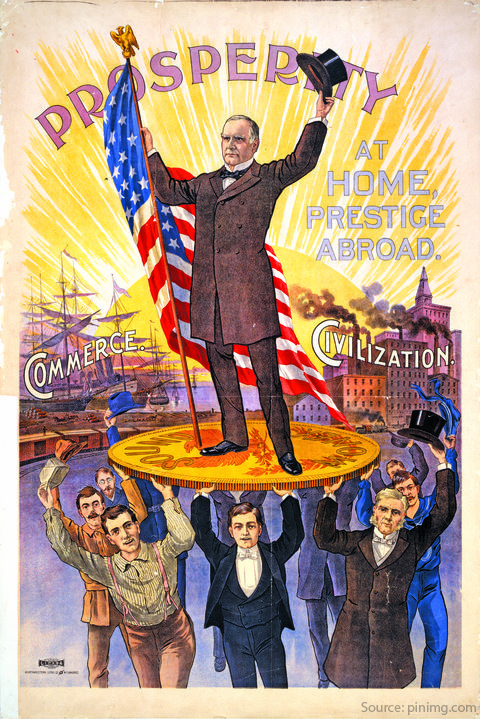

In the photo: on the election campaign poster, the 25th President of the United States, William McKinley, is depicted standing on the gold standard, which the politician introduced nationwide in 1900.

The last stage in the history of the gold standard was the Bretton Woods system* of monetary management, which made the dollar the dominant world currency. Subsequently, the growing number of dollars became inadequate for the US gold reserve, resulting in the abandonment of the gold standard.

The financial shield in an era of instability

After the virtual abolition of the Bretton Woods system in 1971, the price of the valuable metal ceased to be fixed and went up. At the same time, the purchasing power of the dollar began to decrease, falling by more than 80% to date. The world has entered a new financial era that is characterized by fluctuations in exchange rates, uncontrolled inflation and frequent crises.

In the chart: over the past 47 years, the price of gold has grown by 2386%.

Against the backdrop of economic shocks, gold has repeatedly demonstrated stability, rising in price. In the 1990s, the precious metal helped India and South Korea avoid a financial collapse. In 2011, during the global crisis, the price of gold reached a historic high of $1,908 per ounce.

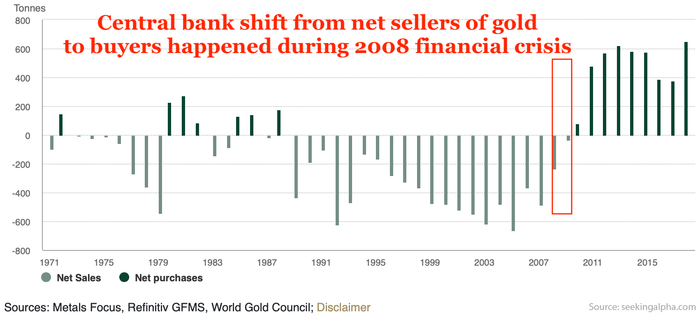

In the chart: the global crisis has convinced central banks of the need to stock up on gold – since 2008, banks shifted from net sellers to net buyers.

The reliability of the yellow metal has prompted millions of people to purchase it for the sake of their savings protection. According to the World Gold Council*, since 2001, the demand for investment gold has been growing at an average rate of 15% per year.

As of today, the price of the valuable metal goes up yet again, signaling a worrisome trend for the global economy. The experience of previous generations proves that gold can withstand any hardship, ensuring Financial Security for both nations and individuals.

Glossary:

*Gold rush — a disorganized massive onrush of miners seeking gold in newly discovered goldfields.

*The gold standard — a monetary system in which each economic unit of account (national currency) is based on a fixed quantity of gold. For example, the US twenty-dollar bill ($20) was equivalent to one ounce of gold (31,1 grams) in 1928.

*The Bretton Woods system — an international system intended to govern monetary relations and trade settlements (1944-1976). The main principle: the US dollar remains an international means of payment that is backed by gold.

*The World Gold Council — the market development organization, founded by the world's leading gold producers to stimulate demand for gold.

![[VIDEO] Young investors choose gold

[VIDEO] Young investors choose gold](https://f01.gig-os.com/74/2c/cc/2b/74/742ccc2b74d465054d6aed797b9de6a1_5.jpg?1)

![[VIDEO] The US legalizes payments in gold [VIDEO] The US legalizes payments in gold](https://f01.gig-os.com/cf/b1/ba/70/55/cfb1ba7055dd2524218f5aabd01efea8_5.webp?1)

![[VIDEO] Record gold demand: market situation in Q1 2025

[VIDEO] Record gold demand: market situation in Q1 2025](https://f01.gig-os.com/0d/85/47/0b/15/0d85470b15a79bc2aabf122c0d401060_5.webp?1)

![[VIDEO] Investors in Asia are buying up gold!

[VIDEO] Investors in Asia are buying up gold!](https://f01.gig-os.com/45/45/84/6f/73/4545846f738945417567ffd2f6f163bb_5.webp?1)

![[VIDEO] Gold price has increased 9 times since the early 2000s!

[VIDEO] Gold price has increased 9 times since the early 2000s!](https://f01.gig-os.com/47/af/07/eb/bb/47af07ebbb01542f14c0aae36a81f1c0_5.webp?1)

![[VIDEO] The US is urgently increasing gold mining — what’s going on? [VIDEO] The US is urgently increasing gold mining — what’s going on?](https://f01.gig-os.com/43/06/89/4d/da/4306894dda97c98b6e595409af58b694_5.webp?1)

![[VIDEO] China sets trends in the global gold market

[VIDEO] China sets trends in the global gold market](https://f01.gig-os.com/5b/81/78/92/92/5b81789292d5e49f20ca7ca093a27cbe_5.jpg?1)

![[VIDEO] Central banks acquired a quarter of the world's gold!

[VIDEO] Central banks acquired a quarter of the world's gold!](https://f01.gig-os.com/81/2d/76/ff/b0/812d76ffb00ee75856059a67a872642c_5.webp?1)

![[VIDEO] Gold: new records amid market volatility

[VIDEO] Gold: new records amid market volatility](https://f01.gig-os.com/03/8b/98/61/b7/038b9861b74be1ae5d57e56e2d2dc859_5.webp?1)