Will gold help stop coronavirus?

In recent months, much has been said about how gold responds to tensions in the global economy in connection with the coronavirus pandemic. In March, the yellow metal price rally has suggested that people around the world need a reliable asset to protect their savings. In early March, the price of gold exceeded $1,700 per ounce, reaching a seven-year high.

However, when speaking about the importance of the yellow metal in the economy, the other important role of valuable metal in the face of epidemiological threats is omitted.

It turns out that gold can be used in diagnosing the COVID-19 virus.

The most important element in medicine

According to Trevor Keel, consultant to the World Gold Council*, gold particles are used in many test kits to diagnose dangerous diseases.

For 40 years, the yellow metal has been used in immunoassays (Lateral flow immunochromatographic assays, aka LFA). Gold is part of indicators that detect the presence of infectious disease pathogens in the body. Every year, hundreds of millions of tests using the LFA technology are conducted in the world, and the vast majority of LFA test kits are gold-based.

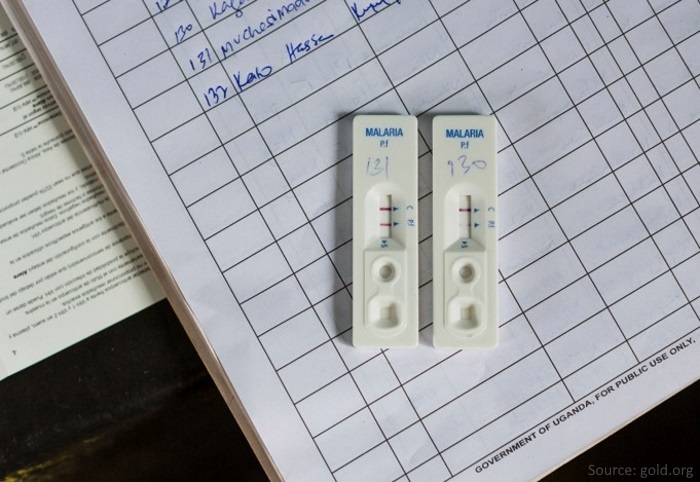

In the photo: malaria LFA tests used in Tanzania allow to establish whether the patient is sick within 15-20 minutes. Gold particles are mixed with a blood sample and then accumulate on a test strip. If they change color to dark purple, then malaria is detected.

Given the spread of COVID-19, doctors need quick and accurate methods for detecting the disease in order to effectively counteract the virus. Laboratory analysis takes a lot of time. Therefore, the LFA technology, allowing accelerated diagnostics outside the laboratory, can bring victory over a new coronavirus closer.

“Medicine” for the financial system

In the meantime, investment gold is strengthening its market position. After experiencing a short-term decline, the price of the yellow metal is on the rise again. According to many experts, 2020 should be extremely successful for gold.

In one of the largest banks in the world, Goldman Sachs, it is believed that the time has come to stock up the most effective defensive asset. “We have long argued that gold is the currency of last resort, acting as a hedge against currency debasement when policymakers act to accommodate shocks such as the one being experienced now,” says Jeffrey Currie, head of commodities at Goldman Sachs.

Optimism regarding gold is shared by the investment bank B. Riley FBR. Bank analysts predict that the price of the yellow metal may reach $2,500 per ounce in the coming summer.

Gold continues to play a key role in various areas of human life. Neither medicine nor economics can sustain without it. The precious metal demonstrates its usefulness and indispensability in critical situations over and over again.

One of the most remarkable properties of gold is its market availability to the general public. The times when only the rich and aristocrats could own the noble metal have long passed. Today, anyone can create a personal gold reserve and use it to ensure Financial Security.

Glossary:

*World Gold Council — the market development organization, founded by the world's leading gold producers to stimulate demand for gold.

![[VIDEO] Young investors choose gold

[VIDEO] Young investors choose gold](https://f01.gig-os.com/74/2c/cc/2b/74/742ccc2b74d465054d6aed797b9de6a1_5.jpg?1)

![[VIDEO] The US legalizes payments in gold [VIDEO] The US legalizes payments in gold](https://f01.gig-os.com/cf/b1/ba/70/55/cfb1ba7055dd2524218f5aabd01efea8_5.webp?1)

![[VIDEO] Record gold demand: market situation in Q1 2025

[VIDEO] Record gold demand: market situation in Q1 2025](https://f01.gig-os.com/0d/85/47/0b/15/0d85470b15a79bc2aabf122c0d401060_5.webp?1)

![[VIDEO] Investors in Asia are buying up gold!

[VIDEO] Investors in Asia are buying up gold!](https://f01.gig-os.com/45/45/84/6f/73/4545846f738945417567ffd2f6f163bb_5.webp?1)

![[VIDEO] Gold price has increased 9 times since the early 2000s!

[VIDEO] Gold price has increased 9 times since the early 2000s!](https://f01.gig-os.com/47/af/07/eb/bb/47af07ebbb01542f14c0aae36a81f1c0_5.webp?1)

![[VIDEO] The US is urgently increasing gold mining — what’s going on? [VIDEO] The US is urgently increasing gold mining — what’s going on?](https://f01.gig-os.com/43/06/89/4d/da/4306894dda97c98b6e595409af58b694_5.webp?1)

![[VIDEO] China sets trends in the global gold market

[VIDEO] China sets trends in the global gold market](https://f01.gig-os.com/5b/81/78/92/92/5b81789292d5e49f20ca7ca093a27cbe_5.jpg?1)

![[VIDEO] Central banks acquired a quarter of the world's gold!

[VIDEO] Central banks acquired a quarter of the world's gold!](https://f01.gig-os.com/81/2d/76/ff/b0/812d76ffb00ee75856059a67a872642c_5.webp?1)

![[VIDEO] Gold: new records amid market volatility

[VIDEO] Gold: new records amid market volatility](https://f01.gig-os.com/03/8b/98/61/b7/038b9861b74be1ae5d57e56e2d2dc859_5.webp?1)