The image of gold: what central banks say

In the era of economic instability, most countries are concerned about Financial Security. The crisis of 2008-2012 forced the central banks of many countries to rethink their asset management strategy and focus on eternal values.

Golden bedrock of Germany

In 2018, the central bank of the Federal Republic of Germany, the Bundesbank, published the book “Germany’s Gold”, dedicated to the German gold reserve. The introduction to the book was written by the President of the Bundesbank, Jens Weidmann, who outlined the attitude of the nation towards the yellow metal:

“Ask anyone in Germany what they associate gold with and, more often than not, they will say that this metal is synonymous with enduring value and economic prosperity. For the Bundesbank, our gold holdings, above all, make up a very large share of the country’s reserve assets and are a major anchor underpinning confidence in the bank. Gold is the bedrock of stability for the international monetary system.”

In the photo: Jens Weidmann, President of the Bundesbank, board member of the European Central Bank, consultant to the Chancellor of the Federal Republic of Germany Angela Merkel.

The following facts confirm the words of Weidmann and the serious attitude of the Germans towards gold:

-

Germany’s gold reserve is the second largest in the world (3366.5 tons).

-

Germany repatriated 674 tons of the yellow metal from foreign vaults, ensuring that half of its gold reserves would be stored in the Bundesbank.

-

In 2019, the Bundesbank renewed the tradition of acquiring gold and made a purchase for the first time in 21 years.

-

Citizens of the country have accumulated more physical gold than their central bank: 4925 tons of investment gold bars and coins and 4000 tons in the form of jewelry.

In the photo:The Bundesbank headquarter in Frankfurt am Main.

Do not think that only the Germans demonstrate a well-deserved confidence in gold. Below are quotes from official statements of central banks of other countries.

The Bank of France:

“Gold is a highly sought-after precious metal, considered to be the ultimate store of value.”

The Bank of Finland:

“Gold is the eternal payment instrument and has been used as a medium of exchange for thousands of years. Gold is a genuinely global means of payment that has maintained its value throughout history. Gold is the basis of a monetary system.”

These are not just mere words — they are backed up by concrete actions. After the global economic crisis, central banks are buying significantly more gold than they are selling. The Netherlands, Austria, Hungary, Turkey, following the example of Germany, also repatriated their gold reserves from foreign vaults.

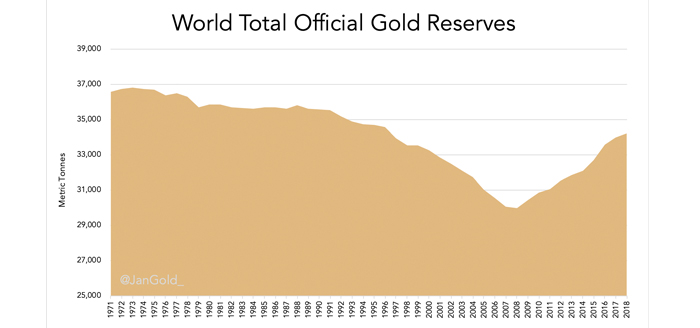

In the chart: world total gold reserves. The chart clearly illustrates how countries were stocking up on the yellow metal following the 2008 crisis.

It is also worth mentioning that the IMF* has developed a Balance of Payments and International Investment Position Manual. Among other things, this document lists and describes all reserve assets, starting with the most significant ones, and gold tops the list.

Exter's Pyramid

The position of central banks on gold has been shared by John Exter, an American economist, former member of the Board of Governors of the Federal Reserve System* and founder of the Central Bank of Sri Lanka.

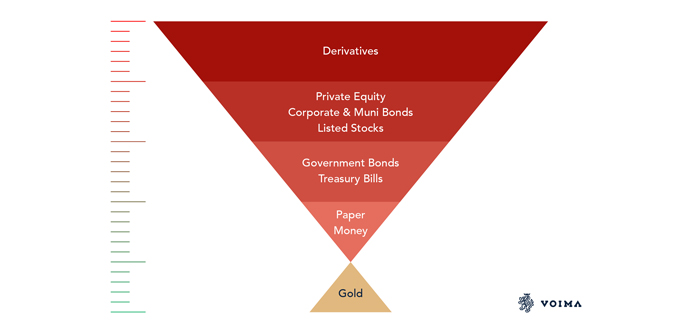

In the second half of the 20th century, Exter created the pyramid of the financial system. The higher the asset in the pyramid, the greater the risks associated with it. At the base of the pyramid is gold — a reliable backbone of the economic system. Exter explained such a hierarchy by referring to the yellow metal as the only totally independent asset in the world, which is not bound by any obligations.

In the photo: Exter's Pyramid.

Today, the Exter’s Pyramid has become too big and unstable. If it begins to crumble, only a strong foundation — gold — can save the system from complete collapse. Central banks that regularly replenish stocks of the precious metal are well aware of this.

The Exter's Pyramid is valid not only for the global economy, but also for every single individual. By creating a personal gold reserve following the example of central banks, everyone can strengthen Financial Security and protect themselves from the crisis.

For this purpose, there are subscriptions on the GIG-OS platform that allow you to stock up your personal gold reserves in the most profitable way. Each subscription provides a certain amount of valuable metal at a special price. The subscription does not impose any obligations — the special conditions of the GIG-OS enable you to buy as much gold as you need whenever you like.

Glossary:

*IMF (International Monetary Fund) — a specialized agency of the United Nations that monitors the stability of the global financial system and provides loans to countries.

*The Federal Reserve System — aka the Fed, is the independent agency that oversees the commercial banking system and acts as the central bank of the United States.

![[VIDEO] Young investors choose gold

[VIDEO] Young investors choose gold](https://f01.gig-os.com/74/2c/cc/2b/74/742ccc2b74d465054d6aed797b9de6a1_5.jpg?1)

![[VIDEO] The US legalizes payments in gold [VIDEO] The US legalizes payments in gold](https://f01.gig-os.com/cf/b1/ba/70/55/cfb1ba7055dd2524218f5aabd01efea8_5.webp?1)

![[VIDEO] Record gold demand: market situation in Q1 2025

[VIDEO] Record gold demand: market situation in Q1 2025](https://f01.gig-os.com/0d/85/47/0b/15/0d85470b15a79bc2aabf122c0d401060_5.webp?1)

![[VIDEO] Investors in Asia are buying up gold!

[VIDEO] Investors in Asia are buying up gold!](https://f01.gig-os.com/45/45/84/6f/73/4545846f738945417567ffd2f6f163bb_5.webp?1)

![[VIDEO] Gold price has increased 9 times since the early 2000s!

[VIDEO] Gold price has increased 9 times since the early 2000s!](https://f01.gig-os.com/47/af/07/eb/bb/47af07ebbb01542f14c0aae36a81f1c0_5.webp?1)

![[VIDEO] The US is urgently increasing gold mining — what’s going on? [VIDEO] The US is urgently increasing gold mining — what’s going on?](https://f01.gig-os.com/43/06/89/4d/da/4306894dda97c98b6e595409af58b694_5.webp?1)

![[VIDEO] China sets trends in the global gold market

[VIDEO] China sets trends in the global gold market](https://f01.gig-os.com/5b/81/78/92/92/5b81789292d5e49f20ca7ca093a27cbe_5.jpg?1)

![[VIDEO] Central banks acquired a quarter of the world's gold!

[VIDEO] Central banks acquired a quarter of the world's gold!](https://f01.gig-os.com/81/2d/76/ff/b0/812d76ffb00ee75856059a67a872642c_5.webp?1)

![[VIDEO] Gold: new records amid market volatility

[VIDEO] Gold: new records amid market volatility](https://f01.gig-os.com/03/8b/98/61/b7/038b9861b74be1ae5d57e56e2d2dc859_5.webp?1)