Why should everyone own gold?

Average reading time — 3 minutes

It doesn’t matter what financial resources you have. Whether you are employed or have your own business. Whether you keep money in the bank or hide cash in a safe place. There is a threat before which all people are equal without exception — the danger of losing savings.

Whenever a crisis strikes an economy, everyone suffers — primarily the poor, the middle class, and even the rich. Both small savings and multimillion dollar fortunes “melt away” with equal ease.

An effective way to protect yourself against such a situation is to diversify financial assets.

Diversification refers to investing in different assets in order to reduce risks.

“Don’t put all your eggs in one basket”

This English proverb is often used by financial experts, implying that savings cannot be trusted to only one asset.

If you drop the basket, the eggs in it will be broken. Therefore, it is reasonable to distribute them among different baskets in order to reduce risks.

For those interested, we will translate the popular proverb into financial language.

In the event that you keep all your savings in one bank, then the collapse of this bank can lead to a complete loss of funds.

At the same time, if all your savings are kept only in a currency, another devastating surge in inflation can ruin you.

CONCLUSION: in order to secure their finances, the owner needs to invest them in various assets.

Here you can not do without gold!

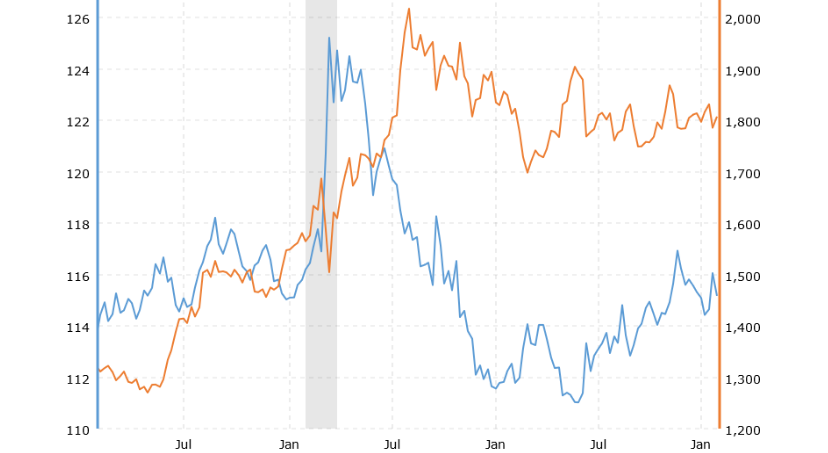

The precious metal is right to be considered one of the best defensive assets. Unlike currencies, it is not subject to inflation and is not controlled by any state. It’s not hard to learn the invariable rule that when the world economy is in trouble, the price of gold usually skyrockets. This was the case at the height of the global crisis in 2011, when the yellow metal set a price record. And so it was in 2020, when, against the backdrop of the outbreak of the COVID-19 pandemic, the price of gold reached a new all-time high.

In the chart: the ratio of gold (yellow) and dollar (blue) rates over the past three years.

The weakening of the US currency, as a rule, leads to an increase in the price of the yellow metal. This process allows the owners of gold to recover losses caused to their dollar holdings. Experienced investors (for example, the globally known Mark Mobius) recommend keeping 10-15% of your savings in the precious metal.

How to become an owner of gold reliably and safely?

The GIG-OS online platform offers everyone an innovative approach to buying gold bars. A flexible subscription system allows you to purchase the precious metal on terms favorable for clients, as it takes into account their personal preferences and needs.

GIG-OS subscriber:

-

buys gold at a special price (- 8% of the order’s total cost);

-

fixes the cost of the order and pays within 14 days, during which the cost remains unchanged and does not depend on the situation in the gold market;

-

enjoys special guarantees and always gets exactly what he/she paid for.

Ensure reliable protection for your savings!

Don’t waste precious time and your own savings — create a personal gold reserve with GIG-OS!

![[VIDEO] Young investors choose gold

[VIDEO] Young investors choose gold](https://f01.gig-os.com/74/2c/cc/2b/74/742ccc2b74d465054d6aed797b9de6a1_5.jpg?1)

![[VIDEO] The US legalizes payments in gold [VIDEO] The US legalizes payments in gold](https://f01.gig-os.com/cf/b1/ba/70/55/cfb1ba7055dd2524218f5aabd01efea8_5.webp?1)

![[VIDEO] Record gold demand: market situation in Q1 2025

[VIDEO] Record gold demand: market situation in Q1 2025](https://f01.gig-os.com/0d/85/47/0b/15/0d85470b15a79bc2aabf122c0d401060_5.webp?1)

![[VIDEO] Investors in Asia are buying up gold!

[VIDEO] Investors in Asia are buying up gold!](https://f01.gig-os.com/45/45/84/6f/73/4545846f738945417567ffd2f6f163bb_5.webp?1)

![[VIDEO] Gold price has increased 9 times since the early 2000s!

[VIDEO] Gold price has increased 9 times since the early 2000s!](https://f01.gig-os.com/47/af/07/eb/bb/47af07ebbb01542f14c0aae36a81f1c0_5.webp?1)

![[VIDEO] The US is urgently increasing gold mining — what’s going on? [VIDEO] The US is urgently increasing gold mining — what’s going on?](https://f01.gig-os.com/43/06/89/4d/da/4306894dda97c98b6e595409af58b694_5.webp?1)

![[VIDEO] China sets trends in the global gold market

[VIDEO] China sets trends in the global gold market](https://f01.gig-os.com/5b/81/78/92/92/5b81789292d5e49f20ca7ca093a27cbe_5.jpg?1)

![[VIDEO] Central banks acquired a quarter of the world's gold!

[VIDEO] Central banks acquired a quarter of the world's gold!](https://f01.gig-os.com/81/2d/76/ff/b0/812d76ffb00ee75856059a67a872642c_5.webp?1)

![[VIDEO] Gold: new records amid market volatility

[VIDEO] Gold: new records amid market volatility](https://f01.gig-os.com/03/8b/98/61/b7/038b9861b74be1ae5d57e56e2d2dc859_5.webp?1)