Financial Security: 10 tips (part 2)

Average reading time — 4 minutes

Surprisingly enough, but already in ancient Babylon children were taught an important science, namely the ability to manage money the right way. It has long been believed that the effective distribution of funds is not so difficult, the main thing is to take the right steps and choose secure financial tools. For example, Warren Buffett decided to become an investor when he was only 7 years old, at the age of 11 he began buying shares. All this suggests that one should learn how to manage money from an early age, but, at the same time, it is never too late to turn to financial literacy.

Today we will continue to introduce you to the tips* of successful people to help you manage money without fear and worry.

*In the first part of our article, we have shared 5 relevant tips from our contemporaries who have achieved success and financial stability.

Tip 6:

“Wealthy people invest in the industries they know best and are in complete control of.”

David Olarinoye, head of the online publication Rich Culture Media

Find your own path, set priorities and goals. The main thing is not to invest in everything. Successfully working with several financial tools at once is unrealistic at first.

It is important not to succumb to impulsive decisions, but to analyze the situation and soberly assess all the pros and cons. A well-informed approach to money and the right strategy will help you achieve results faster and strengthen Financial Security.

Tip 7:

“Give up what doesn’t work for you. Do not waste your energy on a useless pastime that does not provide either the necessary experience or money.”

James Altucher, novelist, bestselling author and entrepreneur

A renowned investor and great motivational speaker believes that it takes at least five years for a person to make noticeable changes. If you intend to live with purpose, then the first year of changes will be filled only with dreams, you’ll be reading books and planning to start doing something. In the second year, you will already map out your travels and start networking. The third year of life will give you the opportunity to earn money that is enough to live on. In the fourth year you will earn more, and in the fifth year you will accumulate your fortune.

The main idea is not to stop, but to go forward and work. Otherwise, when your life is over, it will be impossible to change anything.

Tip 8:

“The money I save on interest without being in debt is better than any profit I could make.”

Mark Cuban, billionaire, entrepreneur

Mark Cuban is confident that any investor can benefit from the “financial hygiene”. This means that debt is the worst thing in the life of an entrepreneur. Debts will stifle all your cherished dreams, turn your business into a burden and prevent you from developing comprehensively.

The world’s largest corporations started out by not borrowing money. Apple and Dell, for example, at the very beginning of their journey, managed without attracting other people’s funds.

Therefore, first of all, rely on yourself. Your account should have an amount that is enough for six months if you suddenly lose your source of income. This is the safety cushion that will allow you to live without fear and debt.

Tip 9:

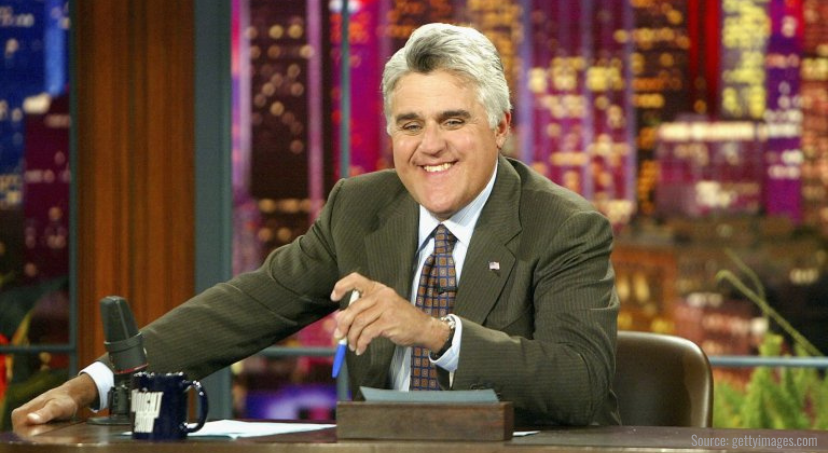

“When I started to get a bit famous, the money I was making as a comedian was way more than the money I was making at the car dealership, so I would bank that and spend the car dealership money.”

Jay Leno, actor, TV presenter, Emmy winner, writer

There are so-called “financial holes” in almost every household. It happens that you are not able to give a clear answer to the question: “Where did the money go again?”

We will surprise you — money can almost always be returned to the wallet. How? Stop buying unnecessary things, overpaying for clothes, fancy gadgets and so on. It’s not boring at all, it’s actually exciting to keep track of the expenses. Smart planning, buying in bulk, saying “no” to excess will help you preserve money that will soon be useful to your family.

Tip 10:

“Set aside money from an early age.”

Carlos Slim, Mexican businessman, billionaire

You want financial freedom and enough money to cover the bare necessities. It takes work, and the sooner you start, the better. Careless squandering of funds will one day take its toll. Therefore, making savings is a sure way to get what you want. But in order to accumulate, you need to learn how to preserve what you have.

Start by investing in yourself, invest in education and other resources that can later generate income. Even if your income is low, you can definitely save 2 euros a day — in such a way, you will save 730 euros a year. Imagine what you can buy with such an amount!

Did it work? Then you already have a goal!

Movement towards the goal

All the tips compiled in this article confirm the main principle of Financial Security — preserve and accumulate. The correctly chosen asset will help ensure the security of your savings. There are many offers on the market, but you need to choose what will help you protect the funds.

There is such an asset, it is gold. The demand for it is constantly growing, in the first quarter of 2022, gold soared in price by 6%. Experts predict new records and a further increase in the cost of the valuable metal. Perhaps you decide not to wait any longer and start taking action right now. We are ready to help you and tell you the most important facts about gold.

On the GIG-OS online platform, you will find more data on the asset that has proven to be reliable and stable.

![[VIDEO] Young investors choose gold

[VIDEO] Young investors choose gold](https://f01.gig-os.com/74/2c/cc/2b/74/742ccc2b74d465054d6aed797b9de6a1_5.jpg?1)

![[VIDEO] The US legalizes payments in gold [VIDEO] The US legalizes payments in gold](https://f01.gig-os.com/cf/b1/ba/70/55/cfb1ba7055dd2524218f5aabd01efea8_5.webp?1)

![[VIDEO] Record gold demand: market situation in Q1 2025

[VIDEO] Record gold demand: market situation in Q1 2025](https://f01.gig-os.com/0d/85/47/0b/15/0d85470b15a79bc2aabf122c0d401060_5.webp?1)

![[VIDEO] Investors in Asia are buying up gold!

[VIDEO] Investors in Asia are buying up gold!](https://f01.gig-os.com/45/45/84/6f/73/4545846f738945417567ffd2f6f163bb_5.webp?1)

![[VIDEO] Gold price has increased 9 times since the early 2000s!

[VIDEO] Gold price has increased 9 times since the early 2000s!](https://f01.gig-os.com/47/af/07/eb/bb/47af07ebbb01542f14c0aae36a81f1c0_5.webp?1)

![[VIDEO] The US is urgently increasing gold mining — what’s going on? [VIDEO] The US is urgently increasing gold mining — what’s going on?](https://f01.gig-os.com/43/06/89/4d/da/4306894dda97c98b6e595409af58b694_5.webp?1)

![[VIDEO] China sets trends in the global gold market

[VIDEO] China sets trends in the global gold market](https://f01.gig-os.com/5b/81/78/92/92/5b81789292d5e49f20ca7ca093a27cbe_5.jpg?1)

![[VIDEO] Central banks acquired a quarter of the world's gold!

[VIDEO] Central banks acquired a quarter of the world's gold!](https://f01.gig-os.com/81/2d/76/ff/b0/812d76ffb00ee75856059a67a872642c_5.webp?1)

![[VIDEO] Gold: new records amid market volatility

[VIDEO] Gold: new records amid market volatility](https://f01.gig-os.com/03/8b/98/61/b7/038b9861b74be1ae5d57e56e2d2dc859_5.webp?1)