Escaping the economic trap: Iranians have high hopes for gold

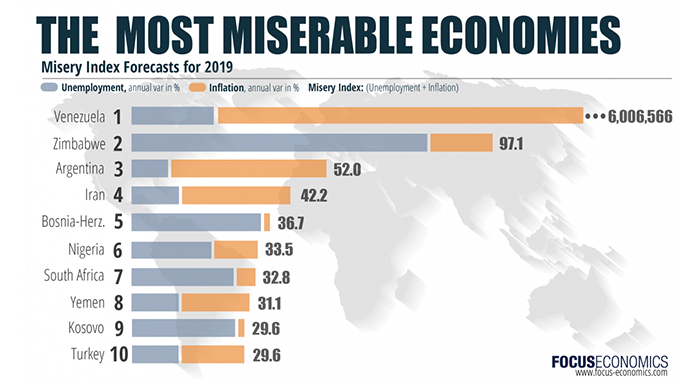

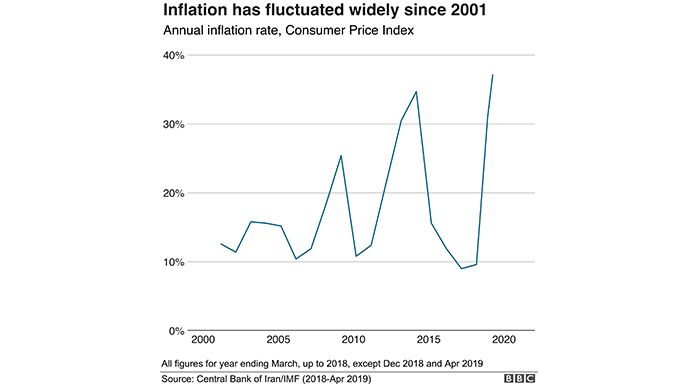

The economy of Iran teeters on the brink of collapse. The US sanctions take a toll on the Middle East: inflation reaches 42%, food prices are going up nonstop. American experts have estimated that the Iranian economy sustained a loss of $50 billion.

How do ordinary Iranians respond to this? They buy gold. According to the World Gold Council*, the local demand for gold has tripled.

In the chart: Iran ranks fourth among the countries with the most miserable economies.

Eternal value

Gold is highly valued in Iran – it is customary to store savings in gold. The country consumes 400 tons of precious metal annually, although only 10 tons are mined.

There are many traditions associated with the yellow metal in Iran. At weddings, grooms often give brides gold coins as an indication of sincerity and seriousness of intentions. Mothers receive the valuable metal from the state for each child born.

Savings protection tool

After a series of tough sanctions imposed by the United States, the Iranians began to buy gold en masse, worrying about the safety of their finances. To meet the growing demand, the Central Bank of Iran issued more than 60 tons of new gold coins. In the country, gold coins can be easily bought or sold without paying taxes.

“People exchange money for gold because it remains a reliable investment product,” says Mohammad Kashtiaray, head of the Gold and Jewelry Committee under Iran's Chamber of Guilds.

Moreover, the central bank allowed Iranian currency exchange services to import gold from abroad, lifting a previous ban on such practices.

In the chart: since 2001, Iran has been susceptible to sharp fluctuations in inflation rates.

Global trade resource

Due to the sanctions imposed, Iran cannot make financial transactions in dollars. Therefore, the government is considering the possibility of trading its main export commodity – crude oil – in exchange for gold.

Iranian energy expert Hassan Khosrojerdi: “The yellow metal will help strengthen our currency. Some African countries have large reserves of gold, and we are open to the idea of oil-for-gold barter.”

The best alternative to money

According to the Iranian press, gold has recently been more actively used as a means of payment in the country. This is particularly evident in the real estate market. In Tehran, the capital of Iran, renting an apartment for local currency has become a challenge, as landlords require gold as payment.

“Dollars are hard to get here, so gold is one of the few alternatives,” explains Alistair Hewitt, head of market research at the World Gold Council.

In the chart: the price of gold in Iranian rials increased by 536% over a decade.

On September 23, 2019, the price of gold was $1,516 per ounce. The price of the noble metal in Iranian currency — 64 million rials.

Iran has often been under pressure of sanctions, ending up in the economic isolation. The local population is faced with the issue of how to strengthen Financial Security. Many generations of Iranians have been convinced of the unreliability of fiat money*. They understand that gold is the only asset that can provide stability in difficult and unpredictable times.

Glossary:

*The World Gold Council — the market development organization, founded by the world's leading gold producers to stimulate demand for gold.

*Fiat money — a currency without intrinsic value (not backed by precious metals), the nominal value of which is established and guaranteed only by the state.

![[VIDEO] Young investors choose gold

[VIDEO] Young investors choose gold](https://f01.gig-os.com/74/2c/cc/2b/74/742ccc2b74d465054d6aed797b9de6a1_5.jpg?1)

![[VIDEO] The US legalizes payments in gold [VIDEO] The US legalizes payments in gold](https://f01.gig-os.com/cf/b1/ba/70/55/cfb1ba7055dd2524218f5aabd01efea8_5.webp?1)

![[VIDEO] Record gold demand: market situation in Q1 2025

[VIDEO] Record gold demand: market situation in Q1 2025](https://f01.gig-os.com/0d/85/47/0b/15/0d85470b15a79bc2aabf122c0d401060_5.webp?1)

![[VIDEO] Investors in Asia are buying up gold!

[VIDEO] Investors in Asia are buying up gold!](https://f01.gig-os.com/45/45/84/6f/73/4545846f738945417567ffd2f6f163bb_5.webp?1)

![[VIDEO] Gold price has increased 9 times since the early 2000s!

[VIDEO] Gold price has increased 9 times since the early 2000s!](https://f01.gig-os.com/47/af/07/eb/bb/47af07ebbb01542f14c0aae36a81f1c0_5.webp?1)

![[VIDEO] The US is urgently increasing gold mining — what’s going on? [VIDEO] The US is urgently increasing gold mining — what’s going on?](https://f01.gig-os.com/43/06/89/4d/da/4306894dda97c98b6e595409af58b694_5.webp?1)

![[VIDEO] China sets trends in the global gold market

[VIDEO] China sets trends in the global gold market](https://f01.gig-os.com/5b/81/78/92/92/5b81789292d5e49f20ca7ca093a27cbe_5.jpg?1)

![[VIDEO] Central banks acquired a quarter of the world's gold!

[VIDEO] Central banks acquired a quarter of the world's gold!](https://f01.gig-os.com/81/2d/76/ff/b0/812d76ffb00ee75856059a67a872642c_5.webp?1)

![[VIDEO] Gold: new records amid market volatility

[VIDEO] Gold: new records amid market volatility](https://f01.gig-os.com/03/8b/98/61/b7/038b9861b74be1ae5d57e56e2d2dc859_5.webp?1)